Let’s look at three dividend shares that yield-hungry investors can consider if they’re looking for new equities.

If you’re like me and want to make money, now might be a good time to look at some unloved dividend shares. I found three FTSE 100 shares that pay more than 3.5% in dividends, but they haven’t gotten much attention in 2025 even though they work in mostly defensive sectors.

Legal & General

Legal & General (LSE: LGEN) is something I believe is worth taking into account. As I write this late on June 16, its share price has increased 9.4% to sit at 256p, marking a respectable if unimpressive start to 2025. With an annual dividend yield of 8.4%, it continues to rank among the top dividend shares of the FTSE 100 despite these gains.

The company is currently trading 4% below its 52-week peak of 266p, with a market cap of over £14 billion. Management revealed the recent large gains after a 5% increase in dividends per share to 21.36p and a 6% increase in core operating profit to £1.62 billion for the year ending March 2025.

My biggest threats are the company’s volatile earnings and the fierce competition in the asset management industry. However, I think that its main life insurance and retirement businesses could offer reliable sources of income to fund its future dividends.

M&G Group

Another high-yield dividend share that I think investors should look into right now is asset manager M&G (LSE: MNG). Although the shares have soared by almost 30% so far this year, the dividend yield is still at a healthy 7.8%.

Similar to Legal & General, M&G’s stock is currently trading at 259p, just below a 52-week high. Nonetheless, management has reaffirmed its goal to maintain or increase the dividend, and operating profit increased by 5% in 2024.

The company’s valuation has soared in recent months due to a recent agreement for Dai-ichi Life to purchase a 15% stake in it and channel $6 billion (£4.4 billion) in new business to it over five years.

This is not to imply that everything is good for M&G investors. Future cash flow may be strained by ongoing fund withdrawals and market volatility, but the high dividend yield makes it worth keeping an eye on.

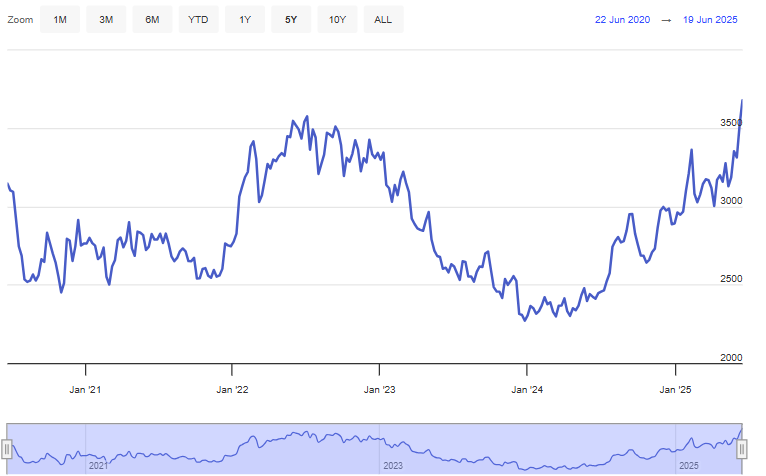

British American Tobacco

One of the leading Footsie dividend shares for a long time has been British American Tobacco (LSE: BATS). Over many years and despite the ups and downs of the economic cycle, the company has been able to provide shareholders with a consistent income.

Despite having a 6.6% dividend yield, the company’s shares are trading at a 26.3 price-to-earnings (P/E) ratio. That’s higher than the Footsie average, which makes sense in my opinion because defensive industries don’t have many reliable dividend payers.

Strong cash flow generation from the company’s core cigarette and next-generation products has supported the dividend’s modest growth.

The main risks here, in my opinion, are shifting consumer behaviour and regulatory risk. Growth may be constrained by tightening regulations on vaping product use, including in the UK. Nevertheless, I believe it’s a tasty dividend yield in a reputable Footsie company that merits more research.

Key takeaway

These unloved dividend shares might be worth considering if you’re interested in making money. Although there is some risk involved, long-term income seekers may find the benefits outweigh the wait.