Although stocks on the continent are in a “sweet spot,”

The second quarter of this year saw an increase in the profits of European listed companies. That wouldn’t be noteworthy in most of the rest of the world. On the old continent, the Stoxx 600, its benchmark index, saw a boost from 4.3% earnings growth in the three months ending June compared to the previous year. Ultimately, the expansion followed four straight quarters of declining profits. European stocks are currently being boosted by market strategists. Investment bank Morgan Stanley even claims to be “in the sweet spot.”

However, this optimism might be misguided. In the end, it is predicated on two factors. One is a more favourable economic climate. Following a year of stagnation, GDP in the European Union increased by 0.3% in the second quarter compared to the first, and annual inflation dropped to 2.8% in July, which is not far from the 2% target set by the European Central Bank. ECB policymakers are anticipated to lower interest rates again in September after feeling secure enough to do so in June.

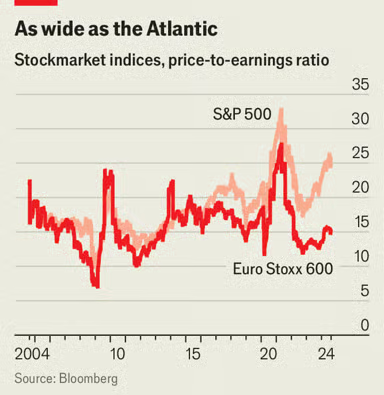

The affordability of European stocks is the second factor. The price-to-earnings ratio of the Stoxx 600 is 15, compared to 26 for the S&P 500 index in the United States. To put it another way, European stocks are 40% less expensive.

The composition of the European market, particularly the significant influence of the luxury and automotive sectors, contributes to the alluring deal.

Growing concerns about a new global trade war, especially if, and profit warnings at a number of well-known companies are hurting automakers.

As China’s housing crisis and other economic issues continue, luxury goods producers are hindered by worries about the outlook for Chinese demand.

However, European companies continue to be significantly less expensive than their American counterparts, even when compared by industry, suggesting that there may be another factor at work. In fact, many investors remain unconvinced of Europe despite increasingly alluring valuations and the better news of recent months.

The price of a basket of stocks that would perform well if the European economy prospered, including businesses in consumer-focused sectors like media and retail, has increased by 6% since mid-April. This is comfortably less than the price of a defensive basket, which includes businesses in more conservative sectors like utilities and health care and has increased by more than 11%.

Instead of hurrying to get exposure to an upswing, asset managers seem to be taking the possibility of a slowdown into account. This isn’t irrational. Even with encouraging signs, Europe’s economy has only expanded by 4% since the COVID-19 pandemic began, while America’s has grown by 9%. Concerns about the weakening demand in Europe and the stagnation in Germany, the continent’s typical economic engine, are also still present.

The share-price discount will not decrease unless there is a significant event that causes investors to reconsider the continent. Cheap assets can remain cheap for a very long time, as anyone who has owned European stocks in the last ten years knows all too well.